Martingale betting strategy in binary options: Trading on Martingale method

Trading strategy on Martingale Method.

Virtually all materials for beginners provides information on how important the Martingale strategy in binary options. This method is referred to as a key, and sometimes almost the only possible for those who want a quick profit and high low binary options demo without opening do not seek to delve into the “wilds” of trading. And it is this method many often limited.

Just want to warn you against such findings. As you have probably learned from my other materials, rapid enrichment using options trading is impossible in principle, and for the Martingale betting strategy is no exception. Moreover, injudicious use of this system does not enrich you and quickly destroy. But the combination of the competent trade with other strategies will allow you to significantly improve your business, to prevent fatal losses.

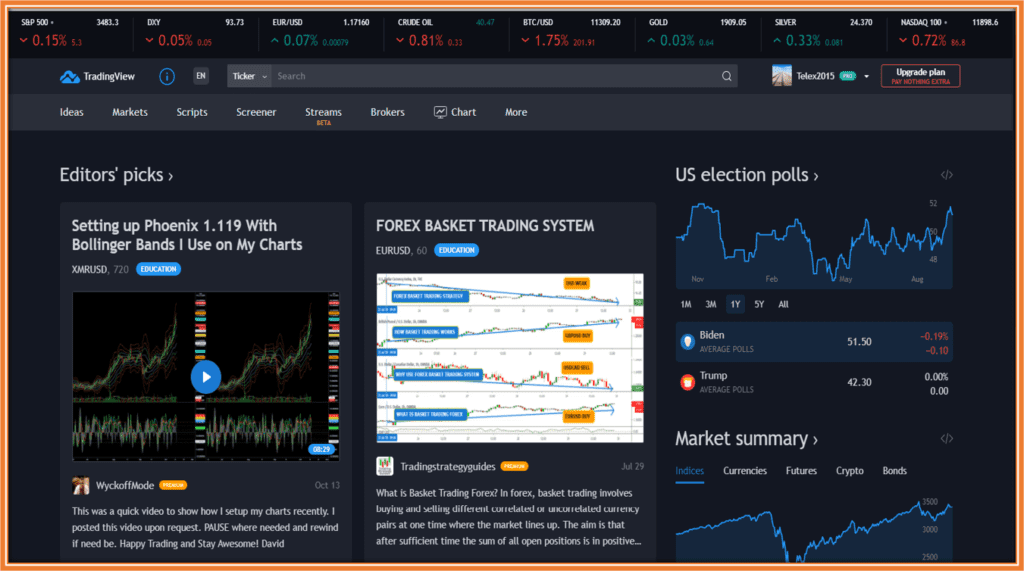

First of all, I recommend to get acquainted with the training video where I, in an accessible form, using clear diagrams, telling about this popular system of work in binary options, including a trick, that it conceals.

Martingale – it’s all about?

This concept (incidentally, its origin is shrouded in fog, binary options trading system 2016 mock but it is not particularly interesting to us) is initially associated with rates, is widespread in gambling, primarily in roulette. That is why the opponents of trading binary options as such do not get tired of comparing this activity with gambling – hinting that in the final case all the work boils down not to the application of knowledge, but to the test of luck, and that invariably in favor of the “casino”. In fact, working in binary options is really a difficult trade and a serious science, but with respect to Martingale’s strategy, one should really be cautious.

What is the Martingale strategy in binary options (and globally)? In short, such a system is a mandatory rate increase after every loss and return to the initial bet after a win. There is the so-called Antimartingeyl, where everything is exactly the opposite, but about him interested can find all the necessary information on their own.

Let us explain in practice. You lose on a bet, for example, 4 dollar – then the next time must put 8 (so that you recoup the loss and stay in profit). Lose 8 – 16 bet, lost 16 – 32 and so on. However, if you win – just go back to the rate at which to begin the game (in this case to 4 dollars). Since 1 or 2 dollars, win, respectively, it is necessary to return to this amount.

No complicated calculations – just the “bare” the theory of probability. That such a system, giving it a miracle-invention, usually offer “lohotronschiki” allegedly made rich on rates in a virtual casino. In fact, such a strategy, if you blindly follow it, will inevitably lead to the loss. Firstly, on the roulette zero falls periodically – and the player does not get the opportunity to double the bet. Second – in the casino usually exhibit maximum rates, and several defeats in a row is simply impossible to recoup.

Martingale and binary options.

Why is this betting strategy is so popular (according to unofficial data, it uses more than 80 percent of traders working in binary contracts)? The answer is clear: the whole thing in the simplicity! None of mathematics, there is no economy – we actually toss a coin and hope that it will not be too many times in a row to drop out of one side.

The main thing – correctly calculate the amount that you can take the risk. Do not forget: the payment for the profitable trade in binary contracts will not be in the amount of 100% of the lot, and less – accordingly, need to cover the loss not twice, and perform calculations. This helps special calculator: to introduce minimum investment rate of return – and get the recommended rate. Calculator, you can use directly on this page, I will describe the details below.